Traditionally known for its conservative and highly regulated nature, the banking sector has experienced a significant transformation in recent years. The emergence of technology has not only transformed how banks interact with their customers but has also reshaped the landscape of services they provide. E-banking is a key part of this transformation, redefining operations for banks and financial institutions and how people manage their finances in today’s digital world. This technological wave has introduced a multitude of opportunities for the banking sector, fostering growth, and elevating the customer experience while simultaneously enhancing operational efficiency.

What is E-Banking?

E-banking, short for electronic banking, encompasses a wide range of financial services and transactions conducted electronically through the internet or other digital channels. This technology-driven approach to banking allows customers to perform various banking activities from the comfort of their own homes or on-the-go using smartphones, tablets, or computers. It includes services such as online banking, mobile banking apps and electronic fund transfers.

Is E-Banking Safe?

Safety is of most importance when it comes to managing one’s finances, and e-banking is no exception. E-banking platforms use encryption to protect your data as it travels over the internet. It also adds layers of security, like Multi-Factor Authentication (MFA) that requires multiple forms of verification, such as passwords and PINs. These systems constantly keep an eye out for suspicious activities and invest in secure networks to keep your information safe. It is worth noting that online banks, much like their traditional counterparts, also offer insurance protection for your funds, providing an additional layer of security.

Advantages for Customers

In today’s fast-paced digital age, e-banking provides convenience and efficiency, offering a broad range of advantages to both customers and financial institutions. Below, we dive into some of the key benefits that make e-banking an increasingly popular choice:

- Convenience: E-banking allows customers to perform banking tasks anytime, anywhere, reducing the need to visit physical bank branches.

- Time-Saving: No more waiting in long queues or adhering to bank opening hours. Users can manage their finances with just a few clicks.

- Cost-Effective: E-banking typically has lower fees and fewer associated costs than traditional banking, such as paper statements or ATM fees.

- Accessibility: E-banking opens up financial services to a broader audience, including individuals with physical disabilities who may find it challenging to visit physical branches.

Why Banks Should Embrace Digitalisation

In the era of digital empowerment, modern consumers demand banking solutions that fit seamlessly into their fast-paced lives. E-banking emerges as the key to meeting these expectations, not only attracting more customers but also setting businesses apart from their competitors. This dynamic shift towards e-banking can do wonders for a bank’s bottom line, significantly reducing operational costs by steering customers towards these efficient digital services, thereby lessening the costs of maintaining physical branches. E-Banking platforms bring additional benefits, including user-friendly budgeting tools and personalized financial advice. These tools not only enhance the customer experience but also foster stronger, more enduring relationships between banks and their clients. In today’s banking landscape, embracing e-banking isn’t just a choice; it’s a strategic move.

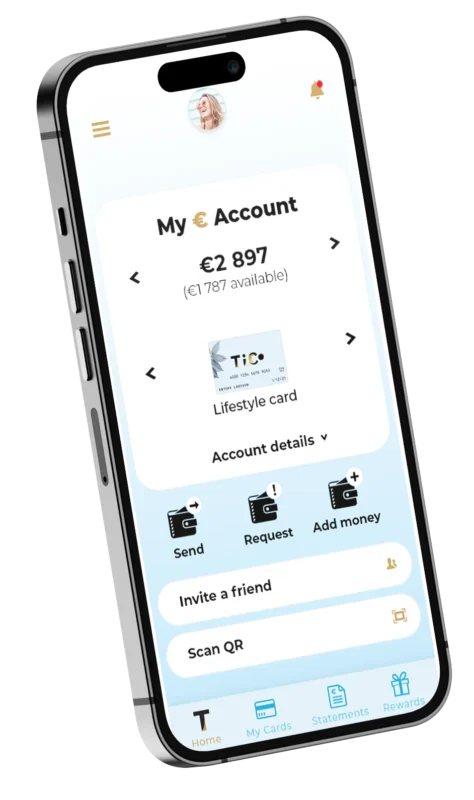

Be1B: Leading the Way in E-Banking Solutions

Be1B takes the lead in providing the most up-to-date e-banking and embedded finance solutions. Our commitment to security, innovation, and user-friendliness ensures that businesses can offer their customers a seamless and secure e-banking experience. Our turnkey e-banking solutions can be personalized to any brand and can be integrated seamlessly with existing or new banking systems, making it easy for businesses and banks to adopt e-banking services.

Ready to embrace the future of banking? Contact us today and explore how our cutting-edge e-banking solutions can transform your financial services!