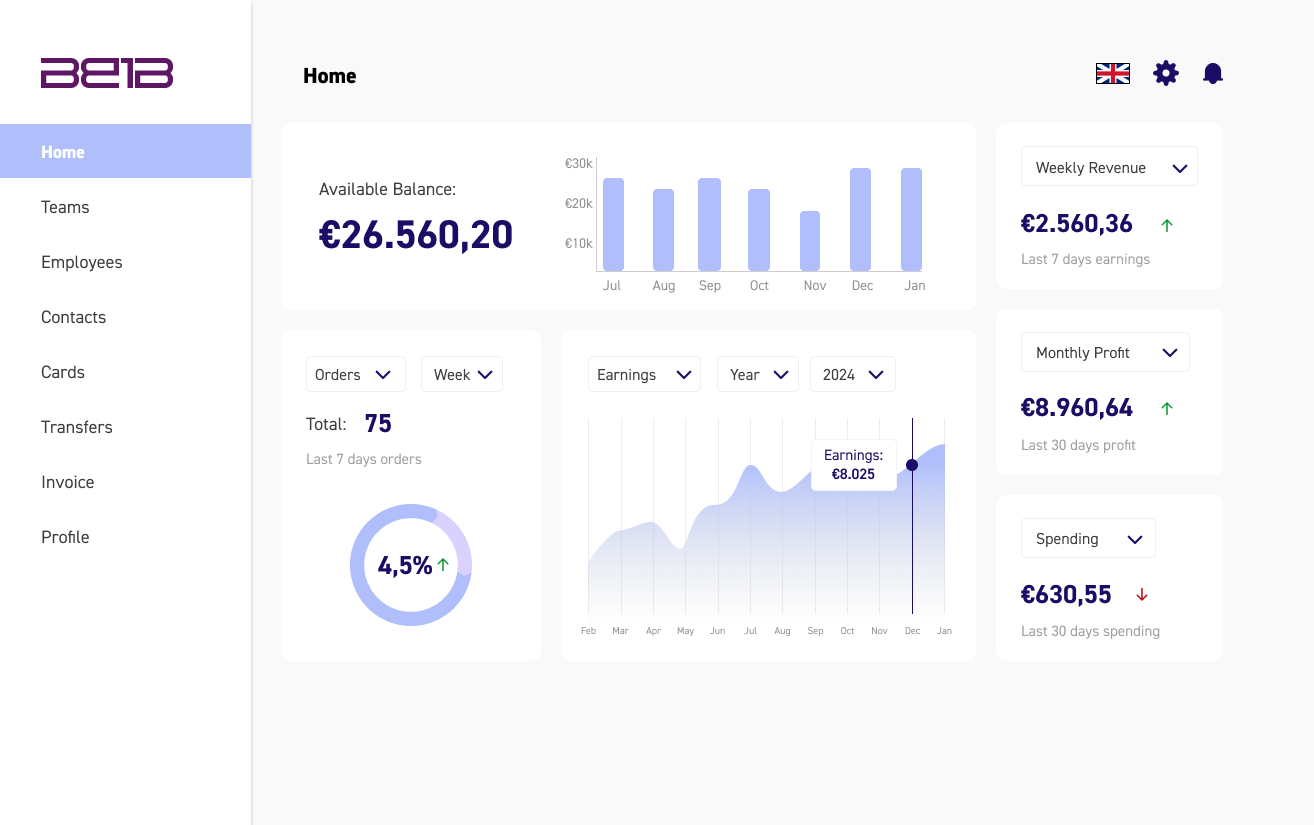

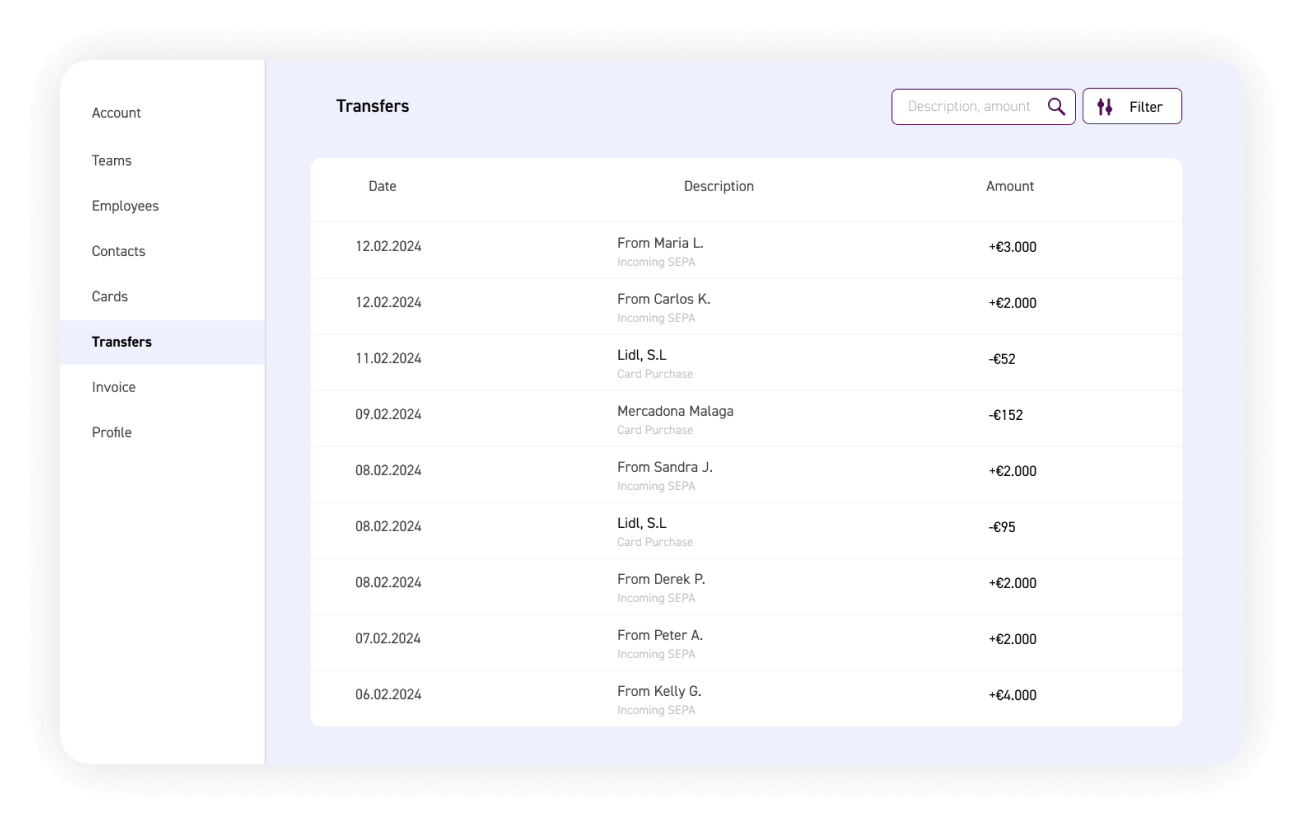

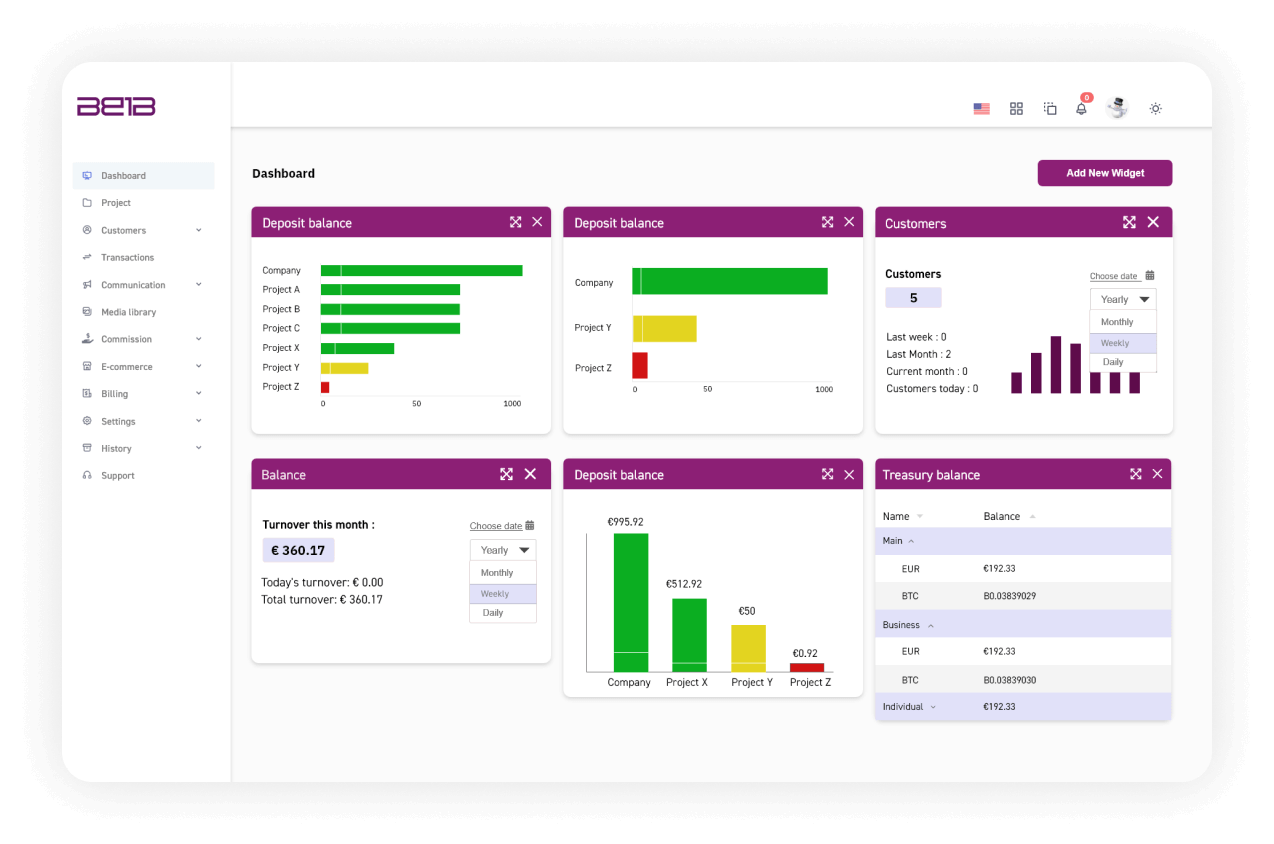

Solution for Banks & FinTechs: Business Digital Banking

Provide a customer-focused banking experience for your business clients, ensuring consistency across digital, mobile self-service, and banker-assisted channels. Fully customizable solution built with microservices architecture, ready to scale and grow with your business. Our mission is to streamline the go-to-market strategy and simplify product lifecycle management by providing advanced technology and tools.