- Solutions & Services

- For Banks

Individual Banking

Corporate Banking

Administration

Digital customer onboarding

100% digital onboarding that maximizes conversions.

Corporate digital banking

Simplify business finances with corporate e-wallets.

Core automation engine

Revolutionise the banking experience with AI-powered innovation.

Individual digital banking

Empower customers with versatile e-wallets.

Card programme management

Launch and oversee multiple card brands with ease.

Business intelligence

Data-driven decisions for confident outcomes.

KYC as a service

Ensure compliance and minimize risk.

KYB as a service

Ensure compliance and minimize risk.

Enabling open banking

Accelerate innovation through open connectivity.

E-Learning

Efficient employee onboarding & training solutions for banking professionals.

Management consultancy

Overcome digitalisation challenges with expertise.

Payment gateway solutions

Avoid transaction failures with reliable gateways.

Bin sponsorship orchestration

Automate reconciliation and simplify licensing for quick card issuance.

E-commerce solutions

Boost customer satisfaction with integrated sales tools.

- For Fintech

Individual digital banking

Adapt to customer needs with flexible wallets.

Corporate digital banking

Optimize corporate finances with secure wallets.

Management consultancy

Address gaps to accelerate fintech success.

KYC / KYB and onboarding solution

Embedded KYC and KYB for seamless onboarding in your wallet app.

BaaS solutions

Launch your fintech in weeks, not months.

Payment gateway solutions

Avoid transaction failures with reliable gateways.

Business intelligence

Navigate challenges with data-driven insights.

Global open banking API

Break down borders with universal banking connections.

E-Learning

Empower teams and clients with flexible learning.

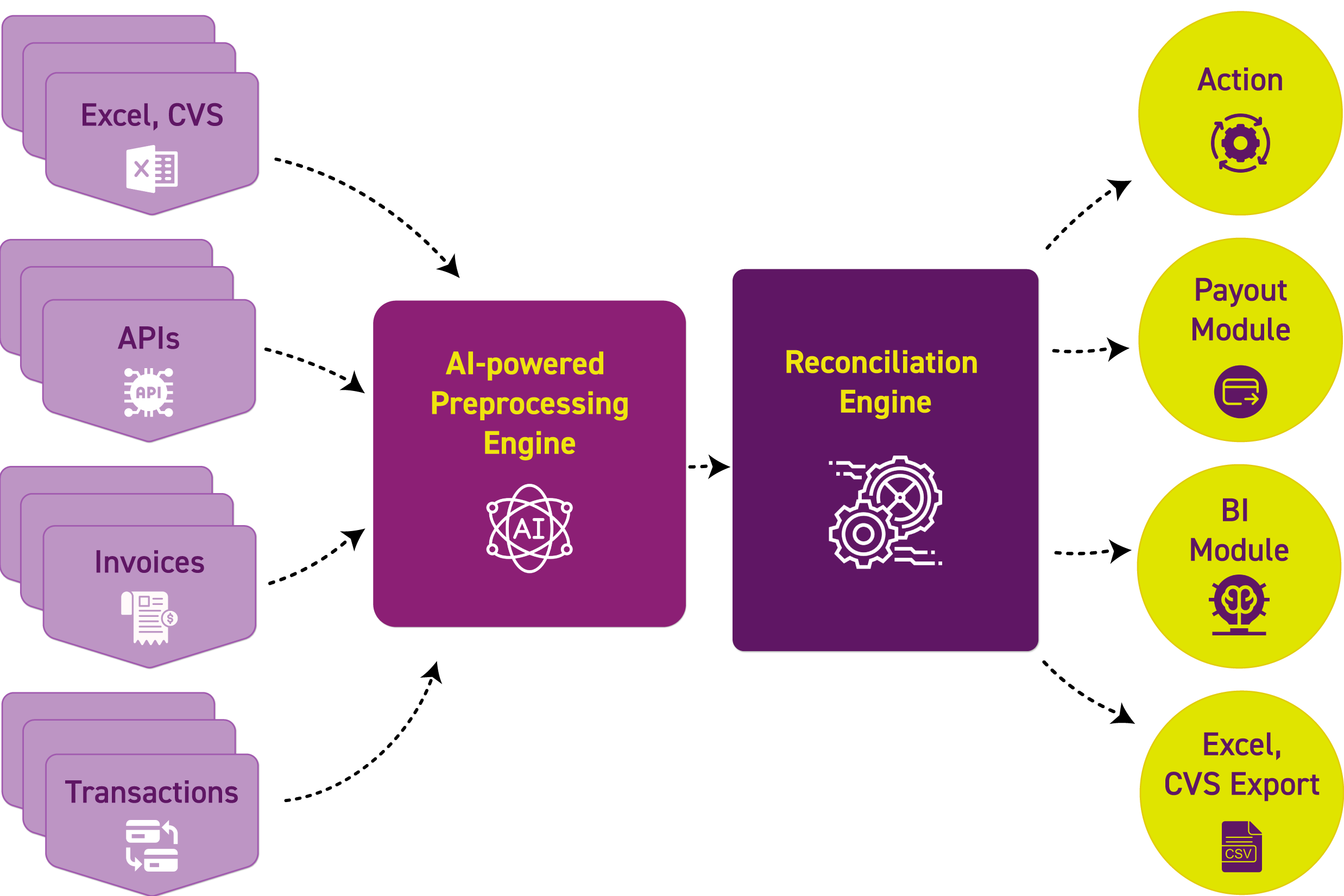

Reconciliation solutions

Gain financial clarity with automated processes.

Embedded e-commerce solutions

Capture retail opportunities within your fintech service.

Proptech solutions

Revolutionize property finance with innovative tech.

Embedded payment solutions

Speed up transactions to meet market demands.

- For Businesses/Merchants

E-commerce-solutions

Break through sales barriers with smart e-commerce tools.

Secure Questionary & onboarding solutions

Enhance client trust with secure onboarding.

Embedded payment solutions

Address payment security and efficiency concerns.

Embedded e-invoicing solutions

Eliminate manual errors and speed up payments.

KYC / KYB solutions

Ensure compliance and protect against fraud.

E-Learning

Deliver seamless training to end users with a personalized learning platform.

The Hub

Explore all the financial tools The Hub offers for your business.

Payment gateway solutions

Avoid transaction failures with reliable gateways.

Enabling open banking

Accelerate innovation through open connectivity.

Reconciliation solutions

Gain financial clarity with automated processes.

Accounts Payable

Automate outgoing payments, cut costs, and eliminate late fees.

Accounts Receivable

Streamline invoicing and get paid faster.

- For Banks

- Company

- The Hub

- Hub Login